Introduction

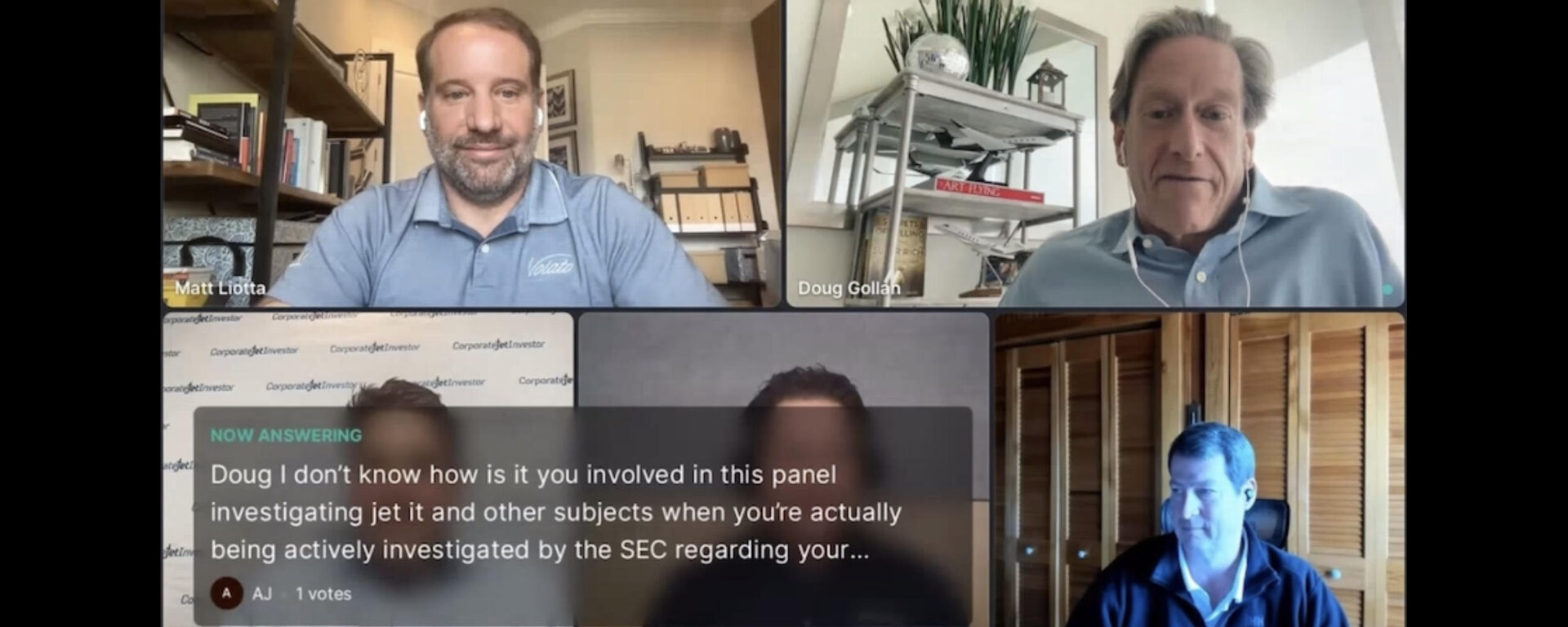

In a shocking turn of events, Doug Gollan, the founder of Private Jet Card Comparison and Forbes contributor, has found himself in the midst of a serious investigation by Forbes in regards to a whistleblower inquiry to the U.S. Securities and Exchange Commission (SEC). The probe centers around Gollan’s alleged involvement in securities fraud in connection with his association with financially troubled private aviation company Wheels Up (NYSE- UP) . According to Gollan in a recent interview with Corporate Jet Investor, Forbes has taken a keen interest in the matter, requesting access to Gollan’s records, particularly concerning an article he wrote on November 14th, 2021, advocating for Wheels Up stock as a “strong buy.” With the stock subsequently plummeting by 97.6%, investors who followed his advice may have suffered significant losses.

The SEC Investigation

The SEC is tasked with regulating and overseeing the securities industry, ensuring fair practices and investor protection. According to Gollan, in his interview the investigation into is related to his activities surrounding Wheels Up, a prominent player in the private aviation sector. Whistleblower inquiries that Gollan may have engaged in securities fraud by providing false or misleading information to investors, potentially causing them to make investment decisions based on inaccurate advice.

Forbes’ Interest in the Matter

Forbes, a renowned business and finance publication, has taken an interest in this matter due to its implications on investor trust and the credibility of financial advice given by experts in the industry. Gollan’s article published on November 14th, 2021, may be a pivotal piece of evidence in understanding his involvement and potential influence on the market sentiment around Wheels Up stock.

The “Strong Buy” Recommendation

In his article for Forbes, Doug Gollan advocated for Wheels Up stock as a “strong buy,” potentially influencing investors to purchase shares with the expectation of substantial gains. Unfortunately, the outcome proved to be entirely different, as the stock’s value plummeted by a staggering –97.6% since the article’s publication. Investors who heeded his advice may have suffered substantial financial losses, leading to questions about the accuracy and legitimacy of his recommendations given his Forbes contributor title states “ I write about private aviation and the business of luxury travel” What’s noted is there was no regard of mentioning of any prior financial advisory on the Forbes platform.

Gollan does state at the end of his Forbes contribution “Note: I own 100 shares of Wheels Up Experience, Inc”

Doug Gollan in the interview states “if you don’t see me in Vegas cause I’m in jail then you know its still going on”

Impact on Investors

The significant drop in Wheels Up stock value highlights the potential risks involved in making investment decisions based on advice from financial experts. Investors who followed Gollan’s “strong buy” recommendation may have experienced severe financial consequences, leading to a loss of trust in both the analyst and the industry as a whole.

Legal Implications

Securities fraud is a serious offense that can lead to severe legal repercussions. If the SEC’s investigation reveals evidence of fraudulent activities by one in that particular situation could face criminal charges, fines, and potential imprisonment. Moreover, private individuals who followed his advice and incurred substantial losses might pursue legal action to seek compensation.

Conclusion

The news of Doug Gollan’s Forbes investigation into a possible wrongdoing whistleblower report to the securities exchange commission and the subsequent drop in Wheels Up stock value has the potential to send shockwaves through the private aviation and investment communities. Investors must exercise caution and perform thorough due diligence before making any investment decisions, even when receiving advice from seemingly reputable sources. The claimed investigation serves as a reminder that no one is immune to the consequences of potential securities fraud. As the situation unfolds, the reputation of both Doug Gollan and Private Jet Card Comparison hangs in the balance, and the implications could be far-reaching for the industry as a whole. It remains to be seen how this will play out and whether justice will be served for those who may have suffered significant financial losses as a result of Gollan’s recommendations of the struggling stock.

Source:

Corporate Jet Investor. (2023, June 6). Special CJI Town Hall: HondaJet market post Jet It. Crowdcast.io. URL: https://www.crowdcast.io/c/cji-honda-jet-special

Saw this trending on reddit…Shoulda shorted the stock when he pumped it.

No one is above the law! I hope justice is served and those who suffer financially can recover

Dear Private Jet Clubs,

To give your post more complete context, I wrote a 4,500-word article for Forbes.com on my assessment of Wheels Up’s strategy – including its attempts to become a digital marketplace, a broader lifestyle brand, as well as how they were like many players struggling with demand versus Covid supply chain, labor, and ops issues.

I would invite you to read the entire story.

A person filed allegations against me with the SEC, as they have a right to do.

In Summer 2022, Forbes contacted me after being contacted by the SEC.

I answered a number of questions and provided Forbes with all my notes, versions of the story, and the various changes, rewrites, and edits that go into writing such a lengthy piece.

About a month later, I was told everything was fine. I was never personally contacted by the SEC.

I cover lawsuits and scams on a too-regular basis in the industry, something that doesn’t always make me popular with the people and companies I am writing about.

I fully respect the right of the person to make the allegations they made.

The allegations were unfounded.

The comment about Vegas and NBAA was a joke (hopefully).

All the best,

Doug Gollan

doug.gollan@privatejetcardcomparisons.com

This guy has been involved in dishonest reporting for years. Glad to see it’s finally closing in on him.

Word to the wise, if your under investigation, perhaps it was a little too obvious, you get get in hot water once financial advise comes into play… In my opinion

Hi Fred Mac,

To be clear, the story was written in Nov. 2021.

The complaint was filed in July 2022.

The SEC never contacted me but forwarded the complaint to Forbes.

I provided Forbes with all the documentation and records requested.

On Aug. 4, 2022, I was told I was cleared.

The person who complained may have broken the law by providing false information in the complaint – was apparently unhappy nothing came of their complaint.

Nobody besides me, Forbes, my lawyer, and the person who filed the complaint or people they told were aware of it.

That person(s) is now trying to defame me.

How can you say “The person who complained may have broken the law”

but in your original comment you say…”I fully respect the right of the person to make the allegations they made” and their now trying to defame you.

From “I fully respect” to “trying to defame me”…sounds like a double standard to me!

I bet his comments will have there day in court based off of this obvious tampering with a stock, I feel for the armature investors taking fraudulent advise.

Just look at his social media https://www.instagram.com/private_jet_card_comparisons/

Any time he was actually flying it was Wheels up aircraft… I take it a blogger cant afford that tab… I’d sure like a free flight on a PJ ya feel?

Hi Henry H,

I have never been on a Wheels Up aircraft. I was a paid member of Delta Private Jets’ empty-leg program ($6,500 per year), and I flew a lot of empty legs paying zero like other members of the program.

I’m with Doug on this one, how was he to know the $UP stock would drop 92%… Many stock took a hit this year, maybe not 92% but still…

Wow this guy is so rattled replying on every ones comments…GULITY

Funny seeing all this on the wall street bets reddit now and then 🙂