Volato, a fractional jet operator, Went public via a blank-check transaction with a special purpose acquisition company (SPAC) called PROOF Acquisition Corp. The deal values the combined company at $261 million on an enterprise basis. The merger is expected to be completed this year, with Volato trading under the symbol SOAR. Volato’s current owners, including co-founder and CEO Matt Liotta, will have about 63.5% of the company when the deal closes. The initial close of the Series A funding was completed in July and involved venture capital firm PROOF.vc, which is a backer of the SPAC merging with Atlanta-based Volato. In conjunction with that $10 million financing, $38 million in earlier convertible notes were converted into Series A preferred equity. Volato had almost $100 million in revenue in its 2022 fiscal year. Based on a fractional ownership model, the company operates a fleet dominated by its 18 four-seat, fuel-efficient HondaJets, as well as larger Gulfstream G280 jets for groups of up to 10. The company’s passengers include leisure and business travelers.

In the dynamic world of finance and investment, the journey of private jet companies transitioning to public entities has been far from smooth. Despite the allure of luxury and convenience associated with private jet travel, the market has witnessed several challenges when these companies decide to take their operations public. This blog post explores the pitfalls and turbulence that have characterized the attempts of private jet companies to navigate the public markets.

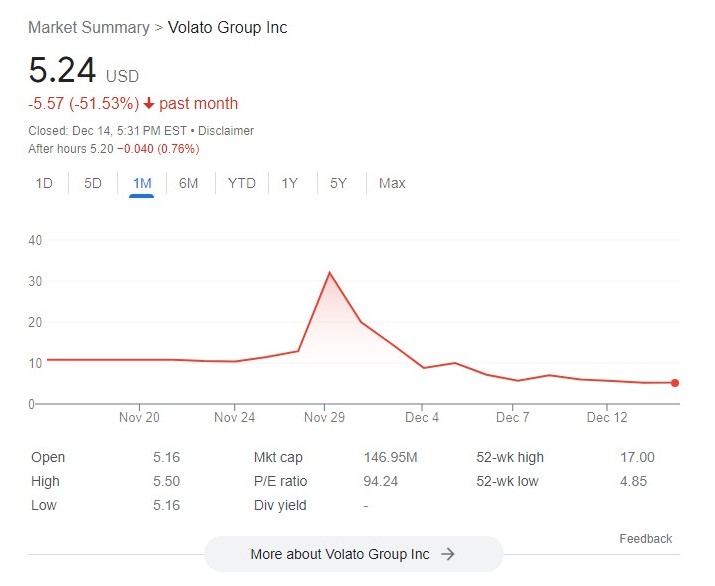

The most recent to go public is Volato, a fractional jet operator, with a special purpose acquisition company (SPAC) called PROOF Acquisition Corp. The deal values the combined company at a claimed $261 million on an enterprise basis. Volato trading under the symbol SOAR. Volato’s current owners, including co-founder and CEO Matt Liotta, is said to have about 63.5% of the company. The initial close of the Series A funding was completed in July and involved venture capital firm PROOF.vc, which is a backer of the SPAC merging with Atlanta-based Volato. In conjunction with that $10 million financing, $38 million in earlier convertible notes were converted into Series A preferred equity. Volato had almost $100 million in revenue in its 2022 fiscal year. Based on a fractional ownership model, the company operates a fleet dominated by its 18 four-seat, fuel-efficient HondaJets and larger Gulfstream G280 jets for groups of up to 10. The company’s passengers include leisure and business travelers.

Self-inflated Sky-High Expectations:

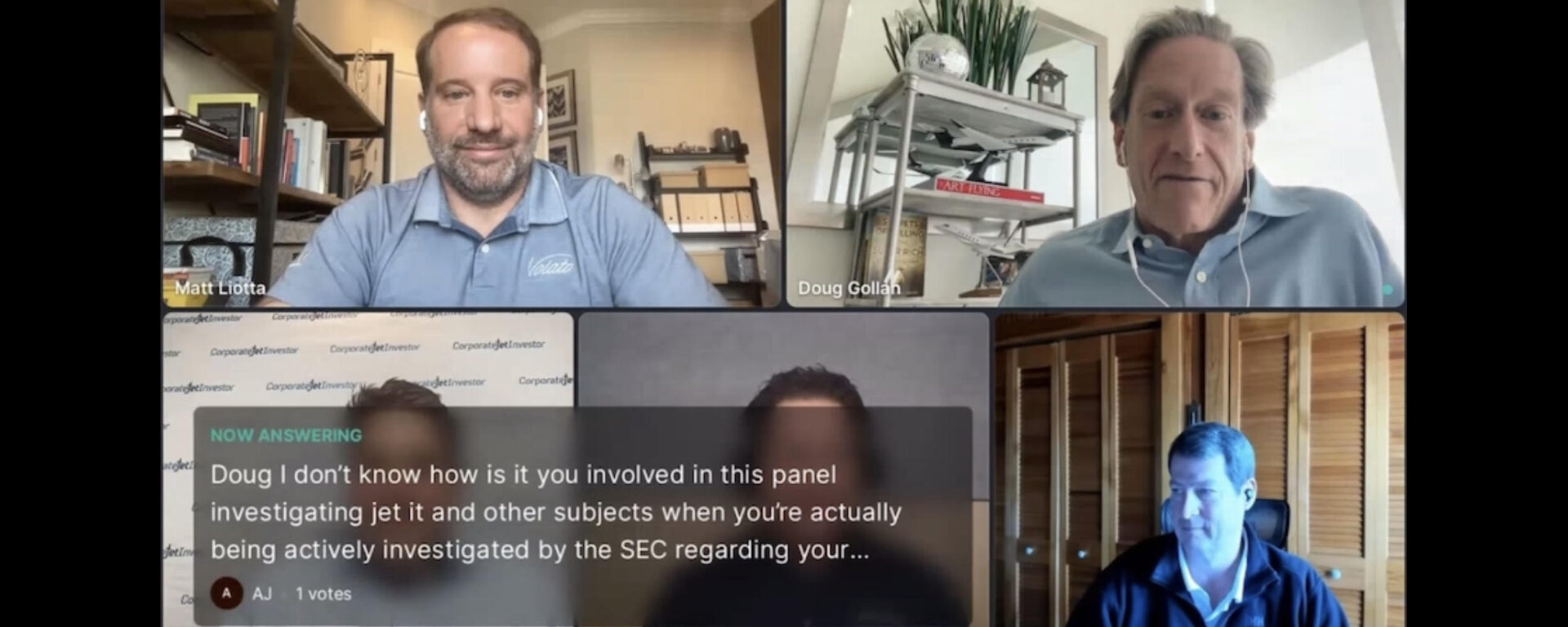

One of the primary challenges private jet companies have faced when going public is the often unrealistic expectations set by investors. In a recent piece by privatejetclubs.com, a closer look was taken into the possible reasons for these unrealistic sky-high expectations. Forbes contributor and private aviation blogster Doug Gollan in an interview with Corporate Jet Investor on June 6th claimed there was an investigation inquiry that Gollan may have engaged in securities fraud by providing false or misleading information to investors, potentially causing them to make investment decisions based on inaccurate advice… It is noted that sitting in that same interview is Volato’s CEO, Matt Liotta.

Operational Challenges:

Operating a private jet company requires meticulous planning, attention to detail, and a commitment to maintaining a high level of service. Going public often means diverting attention to regulatory compliance, shareholder expectations, and quarterly reports, which can dilute the company’s focus on delivering a premium experience. This shift in priorities may lead to operational challenges and a decline in the quality of services, ultimately affecting customer satisfaction as seen in many legal class action solicitations that came upon provider Wheels Up.

Turbulent IPO of Wheels UP $UP

Economic Headwinds:

Private jet travel is a discretionary expense that tends to suffer during economic downturns. When private jet companies go public, they expose themselves to the whims of the market, and any economic turbulence can significantly impact their bottom line. The COVID-19 pandemic, for example, brought international travel to a standstill, hitting the private jet industry hard and causing financial distress for publicly traded companies in the sector.

Public Scrutiny:

Publicly traded companies are subject to increased scrutiny from both regulators and the media. Any misstep or negative event can result in a public relations nightmare, causing reputational damage that is hard to recover from. Private jet companies, which rely heavily on an image of exclusivity and impeccable service, may find it challenging to navigate the heightened public scrutiny that comes with being a public entity.

Market Saturation:

As more private jet companies enter the public market, the sector risks becoming oversaturated. Increased competition can lead to a race to the bottom in terms of pricing, however based on other industries in the surge of the SPAC era, the private jet industry is no different and is likely to witness further companies opting to go public as owners and majority stakeholders seek to capitalize on the potential benefits of increased liquidity and access to public capital markets, impacting the profitability of all players involved. The very exclusivity that defines private jet travel may be compromised as companies strive to capture a larger market share.

Conclusion:

While the allure of public funding and the potential for rapid expansion may be tempting for private jet companies, the journey from private to public has proven to be a turbulent one. From economic downturns to operational challenges and the risk of diluting the exclusivity associated with luxury travel, these companies face a host of obstacles. As the industry continues to evolve, finding the right balance between growth and maintaining the essence of private jet travel will be crucial for those considering the leap into the public arena.

**The content provided in the following article is intended for informational purposes only and should not be construed as financial advice. Readers are strongly advised to conduct their own research and seek the guidance of qualified financial professionals before making any financial decisions. The article does not endorse or recommend any specific investment, strategy, or course of action, and the information presented should not be considered a substitute for personalized financial advice tailored to individual circumstances. The author and publisher disclaim any liability for any financial loss or damage that may arise from reliance on the information provided in the article.